Ask for references from other businesses your customer has dealt with.Buy a credit report to access details of your customer's payment history, overall credit score and trading patterns.

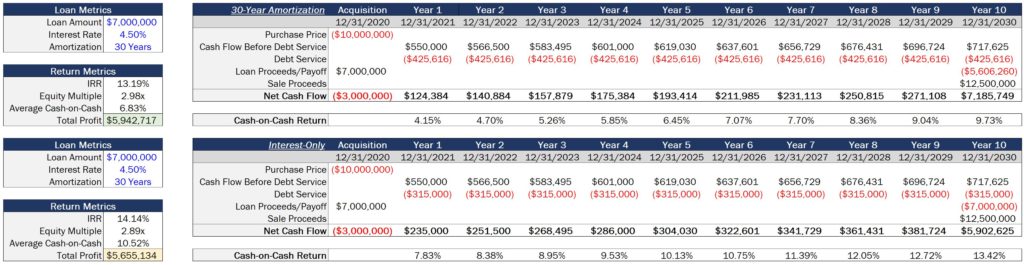

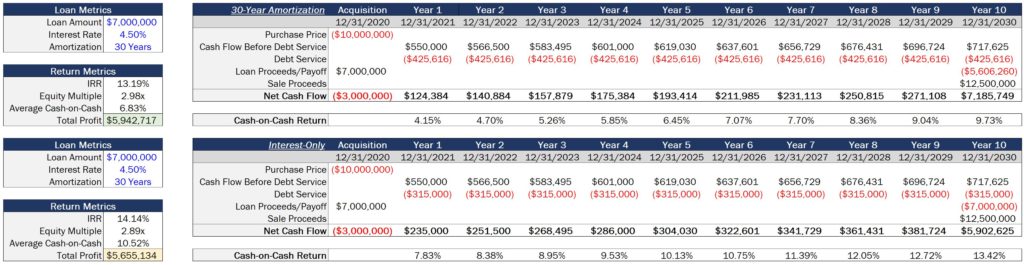

COMPARE TWO LOANS CASHFLOWS FULL

Review the following areas to help you determine your customer's ability to pay in full and on time. The terms and conditions of the application form will give you the right to conduct an assessment. The assessment involves reviewing the customer's financial history to ensure they have a good record of making timely payments.īefore offering credit, ask your customer to complete and sign a credit application form. Large debts-unpaid debts can pose a business risk, especially if these debts are large, single transactions.Ī credit assessment can help protect your business when you want to offer credit to customers.

Keep this in mind when pricing your products and services.

Reduced profit margin-funding credit sales reduces your profit margin and is shown on your profit and loss statement. You could access debtor finance to reduce this risk. Reduced cash flow-delayed customer payments reduce your ability to purchase from suppliers. You must weigh up the potential for increased sales with the risk of reduced cash flow.Ĭreate a policy around credit management that clearly outlines the procedures to follow when offering credit to customers Risks in offering credit gives you a competitive advantage in your market. encourages customers to fast-track or increase spending. Offering credit can also be beneficial to your cash flow as it: This can be risky, so ensure you have good policies in place to minimise the risk to your cash flow. Offering credit as a payment option allows your customers to purchase products or services without paying upfront. Understanding your cash flow will help you make informed decisions about improving your profit and performance. If you are considering taking on debt finance, consider how repayments will affect your future cash flow. To get finance from lenders, you may need a cash flow projection to prove you can make repayments. Your cash flow statement and forecast can help you to identify financial opportunities or risks and ensure your business is heading in the direction you want. Use financial statements to monitor cash flow. You may need a strategy to cover a potential temporary cash shortage to gain the long-term benefit. For example, an advertising campaign will increase your expenses (and lower your cash flow), but the resulting extra sales may increase your revenue (and raise your cash flow again). When making decisions on specific objectives or purchases, consider how this could impact on your cash flow. Review how a decision may impact on cash flow. When you have a good understanding of your cash flow, you can use that information to measure your performance and make informed decisions.

0 kommentar(er)

0 kommentar(er)